With the continual rise of online purchasing, electronic payments are at their peak. This is one of the principal reasons why European regulatory bodies needed to urgently overhaul the original PSD (Payment Service Directive) regulation that dated back to 2007. This new directive came into effect on the 14th September with a twelve month transition period in order for companies to adapt to the new regulatory framework.

The purpose of this regulation is to provide greater security when transacting ‘in the cloud’. For this reason the European Banking Authority (EBA) now requires all banking institutions and electronic businesses to apply a Two Factor Authentication’ (2FA) process. Since its implementation, banking institutions are required to authenticate the identity of users by means of at least two methods, be that by physical device (Identity Document or mobile), confidential information (password) or biometric identification.

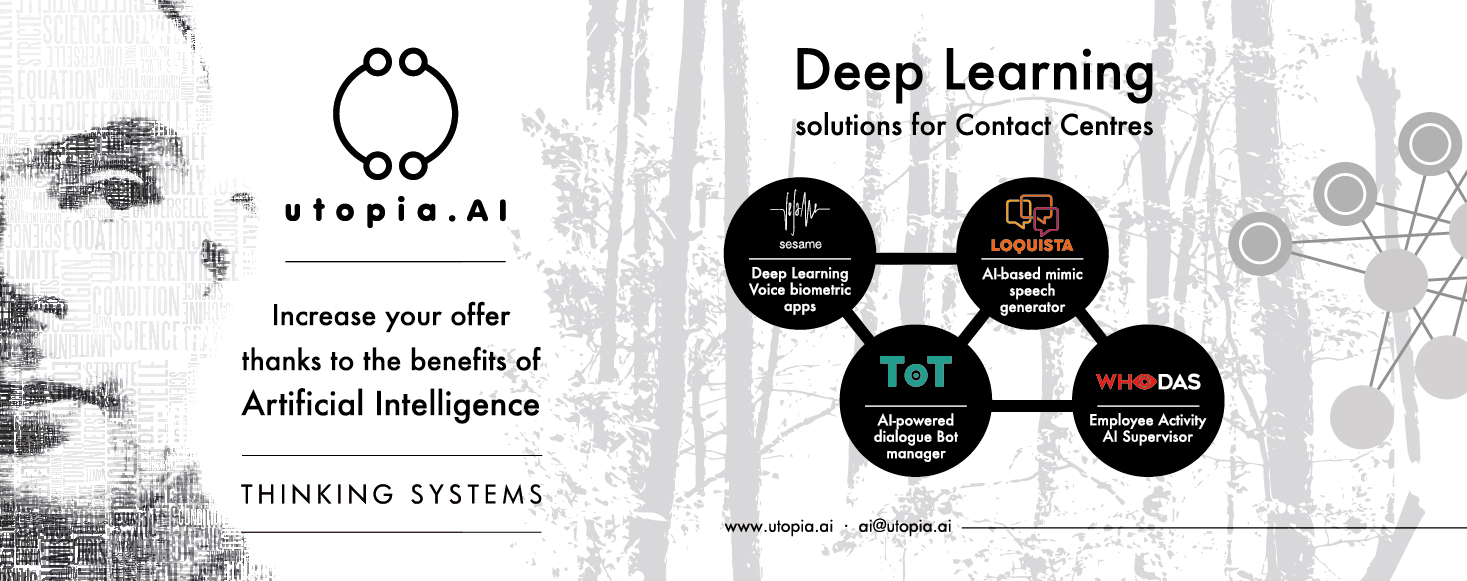

It is this last method of authentication where Sesame can play a fundamental role. This solution, offered by Utopia, meets the Strong Customer Authentication (SCA) requirements by verifying the identity of the user securely through their voice whilst complying with the PCE DSS standard.

This voice authentication application reduces the number of agents in transactions carried out online, eliminating payment gateways and the use of credit/debit cards.The online purchasing process is simplified and a significant decrease in abandonment is expected.

As a result, Sesame is the perfect ally of financial institutions en the development of new payment methods through voice authentication.

utopia.AI. “Sesame adapts to the new PSD2 regulation owing to its voice authentication system”. September 25, 2019.

Recent Comments